Elevate your digital onboarding

To ensure the enrollment of new customers, financial institutions (FIs) must establish the right security controls when verifying their identities. Combating fraud from the moment a customer steps onboard is essential. Additionally, the right mechanisms must be in place to comply with evolving regulations such as the Anti-Money Laundering (AML) Directive v5 and v6, Payment Services Directive (PSD2), Know Your Customer (KYC), and more.

Learn how the onboarding services of the IdCloud platform can support you across all these areas, all within a single, user-friendly platform.

Comply with Regulations

Implement essential security mechanisms, complying with stringent regulations such as KYC, AML, Directive v5 and v6, PSD2, and more.

Maximize User Experience

Optimize the onboarding process for maximum customer ease and convenience.

Cultivate Unparalleled Security

Minimize identity theft and fraud with advanced identity affirmation solutions.

What is Identity Verification?

Identity verification, sometimes referred to as identity proofing or identity affirmation, is the process of confirming an individual's claimed identity. It involves gathering and validating personal information through various means like official documents or biometric data. This process is crucial in preventing fraud and illicit activities in the contexts of online transactions and access. Authentication methods such as facial recognition and fingerprint scanning will enhance the verification process.

HOW THALES CAN HELP

How does IdCloud work? A four-step method to prevent fraud

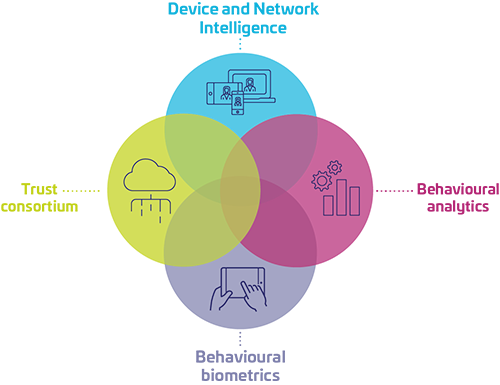

Our cloud-based managed services combines identity-proofing and strong customer authentication to secure onboarding and digital access. Risk management further increases security and enhances the customer experience with identity affirmation and risk-based authentication. IdCloud’s risk management services use four layers of intelligence to confirm identities and authenticate based on risk. These layers analyze user and environmental activities from different angles to spot high risks before any harm occurs. This helps ensure that you're identifying trustworthy consumers based on their online actions.

These intelligence layers create a dynamic profile of each event that protects customers and businesses and allows fraud detection in banking.

Identity verification 4 step diagram

The emergence of passkeys in digital banking

Modern banks are expected to integrate passkeys, moving away from traditional password-based systems. Learn why device-bound passkeys, as opposed to synced passkeys, are the most suitable authentication method for regulated industries such as banking or insurance.

Identity use case

Customer Identity Verification

Verify new and existing customers with the highest level of security. Introduce seamless and secure authentication controls by leveraging biometrics, document verification, and risk analysis.

Thales Named an Overall Leader

Find the product or service that best meets your needs, and learn why KuppingerCole named Thales a Market Leader, Overall Leader, and Innovation Leader in Access Management

The integration of AI in identity verification is set to redefine security protocols. AI's ability to process vast amounts of data and recognize patterns has far-reaching implications for identity verification. This evolution will require a strategic rethinking of current security measures.

Recommended resources

Frequently asked questions

Thales IdCloud employs advanced encryption, biometric authentication, and real-time fraud detection mechanisms to ensure secure identity verification.

Yes, Thales IdCloud is designed to seamlessly integrate with various systems and platforms, offering flexible and scalable solutions tailored to your needs.

Thales IdCloud complies with industry regulations such as KYC (Know Your Customer), AML (Anti-Money Laundering), GDPR (General Data Protection Regulation), and more, ensuring regulatory compliance and data protection.