What is the National Credit Union Administration?

Created by the U.S. Congress in 1970, the National Credit Union Administration (NCUA) is an independent federal agency that insures deposits at federally insured credit unions, protects the members who own credit unions, and charters and regulates federal credit unions.

Regulation | Active Now

The NCUA’s primary function is to identify and assess credit union system risks, threats, and vulnerabilities; determine the magnitude of such risks and mitigate unacceptable levels of risk through its examination, supervision, and enforcement programs. As such, NCUA requires all U.S. federally insured credit unions to establish a security program that addresses the privacy and protection of customer records and information.

The NCUA’s examination program focuses on the areas that pose the highest risk to the credit union system and the Share Insurance Fund. All federally insured credit unions receive an NCUA examination periodically.

To ensure both compliance with applicable laws and regulations, and safety and soundness, a review of the credit union’s information security program is performed at each examination. The “Information Security” booklet is an integral part of the Federal Financial Institutions Examination Council (FFIEC) Information Technology Examination Handbook (IT Handbook) and should be read in, conjunction with the other booklets in the IT Handbook. This booklet provides guidance to examiners and addresses factors necessary to assess security risks to a financial institution’s information systems.

Institutions should maintain effective information security programs commensurate with their operational complexities. Information security programs should have strong board and senior management support, promote integration of security activities and controls throughout the institution’s business processes, and establish clear accountability for carrying out security responsibilities.

All credit union entities chartered and supervised by the National Credit Union Administration. Recent 2022 enforcement actions imposed monetary penalties in the $4.5 million to $5million range.

How Thales Helps with NCUA Compliance

Thales helps credit unions comply with the NCUA information security requirements and pass required examinations by addressing key risk mitigation requirements outlined in the NCUA Information Security Booklet.

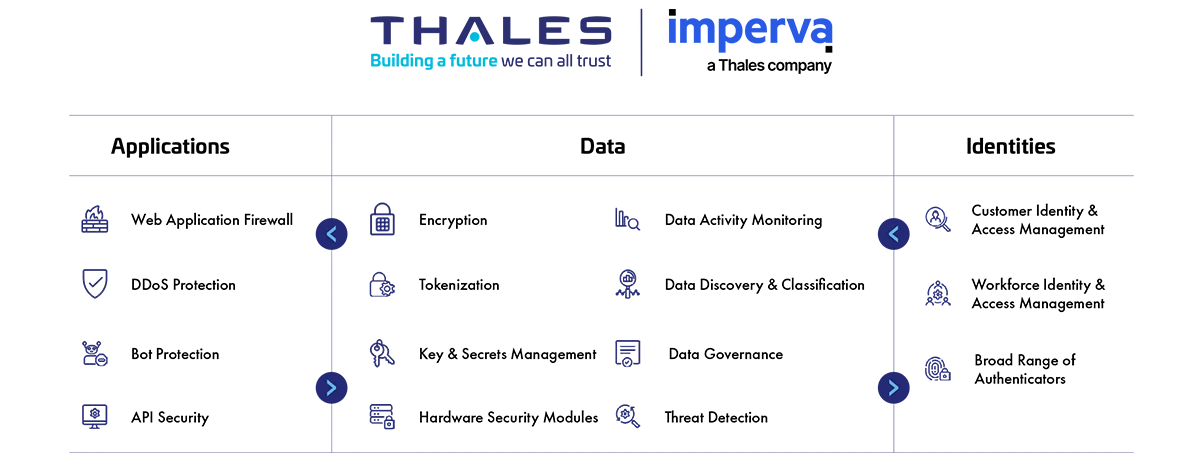

We provide comprehensive cyber security solutions in three key areas of cybersecurity: Application Security, Data Security, and Identity & Access Management.

NCUA Compliance Solutions

Application Security

Protect applications and APIs at scale in the cloud, on-premises, or in a hybrid model. Our market leading product suite includes Web Application Firewall (WAF), protection against Distributed Denial of Service (DDoS) and malicious BOT attacks, security for APIs, a secure Content Delivery Network (CDN), and Runtime Application Self-Protection (RASP).

Data Security

Discover and classify sensitive data across hybrid IT and automatically protect it anywhere, whether at rest, in motion, or in use, using encryption tokenization and key management. Thales solutions also identify, evaluate, and prioritize potential risks for accurate risk assessment as well as identify anomalous behavior, and monitor activity to verify compliance, allowing organizations to prioritize where to spend their efforts.

Identity & Access Management

Provide seamless, secure and trusted access to applications and digital services for customers, employees and partners. Our solutions limit the access of internal and external users based on their roles and context with granular access policies and Multi-Factor Authentication that help ensure that the right user is granted access to the right resource at the right time.

Address Key NCUA Information Security Booklet Section IIC – Risk Mitigation Requirements

How Thales helps:

- Identify structured and unstructured sensitive data at risk across Hybrid IT.

- Identify current state of compliance and documenting gaps.

- Discover and classify potential risk for all public, private and shadow APIs.

How Thales helps:

- Limit access to systems and data based on roles and context with policies.

- Apply contextual security measures based on risk scoring.

- Centralize access policies and enforcement to multiple hybrid environments in a single pane of glass.

- Provide customers secure access to their information in company’s systems.

How Thales helps:

- Protect data in motion with high-speed encryption.

- Certified FIPS 140-2 L3, Common Criteria, NATO, UC APL

How Thales helps:

- Locate structured and unstructured regulated data across hybrid IT and prioritize remediation.

- Remove keys from CipherTrust Manager can ensure secure deletion, digitally shredding all instances of the data.

How Thales helps:

- Enable secure remote access for employees to all company resources on-premises or in the cloud with seamless user experience.

- Enable MFA with the broadest range of hardware and software methods.

- Build and deploy adaptive authentication policies.

Solutions:

Identity & Access Management

How Thales helps:

- Provide customers secure access and seamless experience.

- Enable MFA with the broadest range of hardware and software methods.

- Enable customers to manage data privacy with consent and privacy management.

How Thales helps:

- Protect apps from runtime exploitation, while integrating with tools in the CI/CD pipeline.

- Detect and prevent cyber threats with web application firewall, ensuring seamless operations and peace of mind.

- Safeguard critical network assets from DDoS attacks and Bad Bots while continuing to allow legitimate traffic.

- Deploy data protection controls in hybrid and multi-cloud applications to protect DevSecOps.

- Protect and automate access to secrets across DevOps tools.

- Easily access data security solutions through online marketplaces.

Solutions:

Application Security

Data Security

How Thales helps:

- Transparent column-level encryption of structured, sensitive data in databases with centralized key management.

- Pseudonymize sensitive information in databases.

How Thales helps:

- Encrypt data at rest on-premises, across clouds, and in big data or container environments.

- Protect cryptographic keys in a FIPS 140-2 Level 3 environment.

- Protect data in use by leveraging confidential computing.

- Gain full sensitive data activity visibility, track who has access, audit what they are doing and document.

- Security products designed for post-quantum upgrade to maintain crypto-agility.

How Thales helps:

- Reduce third party risk by maintaining on-premises control over encryption keys protecting data hosted by in the cloud.

- Enforce separation of roles between cloud provider admins and your organization, restrict access to sensitive data.

- Monitor and alert anomalies to detect and prevent unwanted activities from disrupting supply chain activities.

- Enable relationship management with suppliers, partners or any third-party user; with clear delegation of access rights.

- Minimize privileges by using relationship-based fine-grained authorization.

Solutions:

Data Security

Identity & Access Management