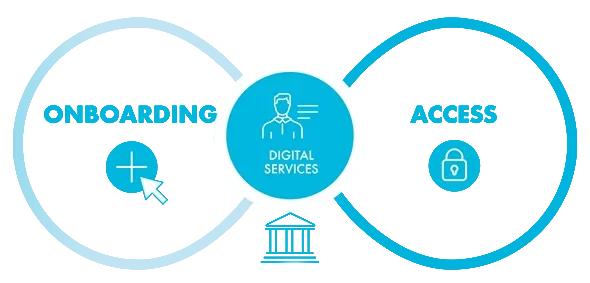

Secure onboarding and access to digital banking services

Digital banking offers financial institutions and their customers unparalleled convenience. For customers, it means easier access to banking services anytime, anywhere. For financial institutions, digital banking reduces costs associated with physical infrastructure and operations while opening new revenue streams.

At Thales, we help institutions embrace digital transformation with a multi-layered security approach that builds trust, supports regulatory compliance, and strengthens customer protection. Our solutions deliver a seamless, secure user experience without sacrificing convenience.

Identity Verification

Proof and validate the identities of your customers online with KYC requirements.

Strong Customer Authentication (SCA)

Improve security and meet regulatory requirements with passkeys and strong authentication measures.

Risk-Based Authentication (RBA)

Minimize fraud-related risks with adaptive authentication capabilities.

Passwordless and Passkeys

Empower your customers to eliminate passwords and facilitate easier re-engagement with your brand

PSD2 Compliance

Understand and address PSD2 requirements related to strong customer authentication, risk assessment, and open banking API.

Fraud and Risk Management

Ensure that only legitimate users gain access to digital banking services.

Identity & access management solutions for digital banking

Our comprehensive suite of digital banking solutions safeguards customers from external threats, providing frictionless yet robust authentication combined with advanced risk management. Available as both cloud services and on-premises deployments, these solutions offer flexibility and security to meet the needs of today’s digital banking landscape.

Featured Solution

Cloud platform to secure digital banking

Our IdCloud solution is now part of the cloud-based OneWelcome Identity Platform. It combines KYC/Identity Verification, authentication, and risk management services to secure onboarding and access to digital banking services and enhance the customer journey with one single API.

Mobile authentication

Our Mobile Authentication Suite brings state of the art security to the mobile channel and allows all other transaction channels to be secured with the mobile.

Authentication server

Confirm Authentication Server (CAS) is the heart of the world’s most versatile, scalable, and secure authentication solution dedicated to protecting digital banking with multi-factor authentication.

OTP authentication

Connected or unconnected, our authentication devices meet the multi-factor authentication security requirements for “something you know” and “something you have” very effectively.

Corporate banking

Learn about our PKI and What-You-See-Is-What-You-Sign solutions to mitigate social engineering attacks in corporate banking.

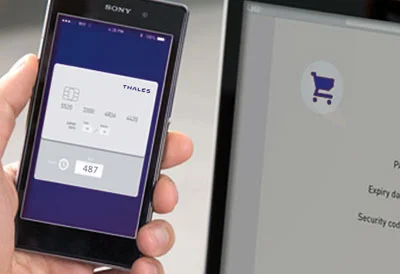

Dynamic code verification

Slash card-not-present fraud with our Gemalto Dynamic Code Verification solution that replaces static cryptograms with dynamic codes.