Embrace the highest level of security in online banking

The financial sector’s digital evolution is fueled by shifts in consumer behavior, market competition, and technological progress. Nevertheless, the challenges posed by cybersecurity vulnerabilities and tighter regulations amplify risks and expenses associated with digital transformation efforts. Thales’s fraud and risk management solutions help financial institutions effectively mitigate risks, manage costs, handle regulations effectively while expediting digital transformation.

Reduce security risks

Mitigate fraudulent activities with dynamic risk and fraud assessments.

Comply with regulations

Implement robust risk and fraud management practices ensuring compliance with relevant regulations and industry standards

Accelerate digital transformation

Deliver competitive, fast, and convenient digital experiences today’s customer expect.

Access management risk assessment tool

By using this will free assessment tool, you will:

- Gain improved insight into your progress within the cloud adoption process.

- Receive recommendations on implementing access security tailored to your current level of cloud adoption.

- Learn strategies for expanding your existing access security measures to encompass the cloud environment.

What is fraud and risk management?

Fraud and Risk Management encompasses a set of strategies and tools aimed at identifying, preventing, and mitigating fraudulent activities and potential risks within an organization. It involves the implementation of measures such as robust authentication methods, continuous monitoring, data analysis, and security protocols to safeguard against various forms of fraud, including identity theft, financial fraud, and cyberattacks. By proactively detecting and addressing threats, Fraud and Risk Management helps to protect assets, reputation, and customer trust, ensuring the integrity and security of operations within the organization.

What type of identity do you want to protect?

Customer

Create frictionless and secure access for your customers

B2B & 3rd parties

Streamline access and collaboration across your entire B2B ecosystem

IAM Trends

75% of decision-makers surveyed in our research study conducted by Enterprise Strategy Group said legacy identity tech is holding back innovation.

How does risk and fraud management work?

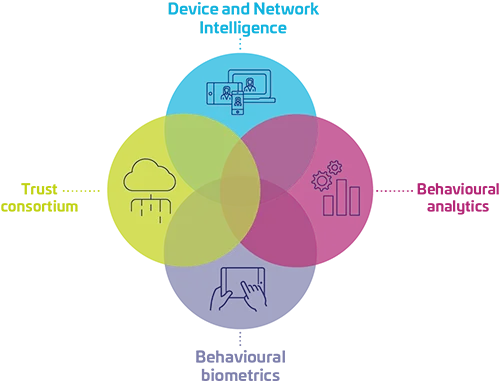

Leveraging advanced technologies and robust algorithms, our system analyzes vast amounts of data to detect suspicious patterns and anomalies during customer onboarding and transactions. Through a combination of identity verification, strong authentication mechanisms, and continuous monitoring, we ensure that only legitimate users gain access to digital banking services while swiftly identifying and mitigating potential threats.

Our risk-based approach enables dynamic adjustments to security measures based on evolving threats, thereby providing a proactive defense against fraud while maintaining a seamless user experience.

Benefits of Fraud & Risk Management

Our cloud-based managed services enable financial institutions to provide secure onboarding and access to digital banking with identity proofing and strong customer authentication (SCA). Additionally, our risk management solutions bolster security and improve customer experience through identity validation and risk-based authentication (RBA).

All these capabilities are seamlessly integrated into the OneWelcome Identity Platform.

Real-Time Detection

Find anomalous activity before it results in fraud.

With our real-time solution, threats get blocked as they try to access your environment.

Customized Security

Your traffic, your rules.

We help you secure your environment on your own terms. Automate the actions you want based on your user's risk levels and risk thresholds.

Multi-Channel Security

Have all devices under control.

We provide the same level of security on every device. Whether your customers are using mobile, tablet or desktop we've got them covered.

Transparent to the Customer

Protect your customers passively.

By looking at behavioral and device-based information, protect your users while they seamlessly enjoy your environment. No friction added.

Recognise your good users

With our +99% accuracy, you avoid false declines and unnecessary friction.

Reduce friction and treat your good customers with the trust they deserve. Leave friction for high-risk traffic only.

Less Manual Reviews

Relieve your fraud team.

High level of accuracy and powerful analyses tool allows your fraud team to focus on the most critical cases and uncover new fraud patterns.

Thales named an overall leader

Find the product or service that best meets your needs, and learn why KuppingerCole named Thales a Market Leader, Overall Leader, and Innovation Leader in Access Management

Recommended resources

Frequently asked questions

When selecting a Fraud and Risk Management solution, it's essential to prioritize several factors. Firstly, robust data security measures are paramount to protect sensitive information from unauthorized access and fraudulent activities. Secondly, seamless integration with existing systems ensures smooth operations and minimizes disruptions to business processes. Additionally, a user-friendly interface enhances usability and adoption among employees, leading to more effective risk management practices. Lastly, scalability is crucial to accommodate future growth and evolving security needs.

While implementing a Fraud and Risk Management solution may involve some adjustments to workflows and applications, our dedicated team of experts strives to ensure a seamless transition. By carefully planning the integration process, we aim to minimize disruptions to your business operations and maintain a positive user experience. Our priority is to facilitate a smooth and efficient transition, allowing your organization to continue operating effectively while enhancing security measures against fraud and risk.

Yes. Our flexible modular approach allows businesses to acquire Fraud and Risk Management as a standalone solution, tailored to their specific security needs. This means you can implement comprehensive fraud prevention and risk management capabilities without the necessity of broader Identity and Access Management (IAM) functionality. Whether you require targeted security measures or comprehensive IAM solutions, our adaptable platform ensures you can customize your security infrastructure to suit your unique requirements.