Will the arrival of phone based payments act as a revolutionary or evolutionary force?

Thales, leader in information systems and communications security, looks at the approaches for the successful mass adoption of mobile payments among issuers, card schemes, acquirers, merchants and consumers and asks whether the arrival of emerging mobile payment technologies and increasingly secure cloud services will act as a revolutionary or evolutionary force?

The payments industry was defined in an era before the internet, smartphones, the app store and the cloud. As a result any new payments ecosystem built around mobile and cloud connectivity could look very different to the world of payments we are currently familiar with – to both the industry and consumer alike.

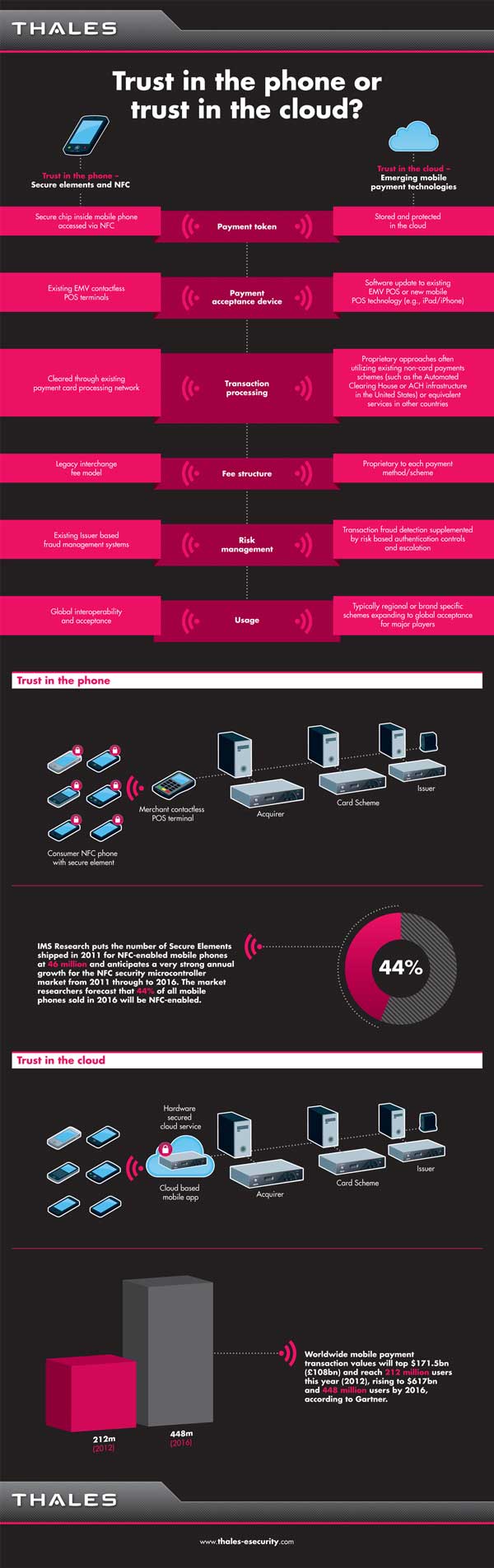

To date the most widely discussed and broadly standardized approach to mobile payments has been evolutionary and has focused on effectively turning the phone into a credit card or a wallet full of credit cards. In this model, card issuers, card schemes and acquirers, play a familiar role despite ceding some control and power to new entrants such as Trusted Service Managers (TSMs), Mobile Network Operators (MNOs) and even handset manufacturers. They collectively depend on the presence of a specialist security chip within the phone – known as the Secure Element – to protect the critical payment keys that enable the consumer to initiate a contactless mobile transaction at a point of sale terminal, just like the embedded chip in an EMV enabled plastic payment card world.

However, players such as PayPal, Google, Apple and a host of innovative start-ups like Square, take a different approach. Their trust lies in the cloud and the phone is simply a means of connecting to that cloud. The argument being that it is much easier to secure a common cloud service than millions of individual phones and much more in intuitive for users to simply log-on to a service – something they do every day.

Which of the two models is likely to stimulate the successful mass adoption of mobile payments – the secure element model or the cloud-oriented approach – and what are the opportunities and threats to gain or lose market share? See the infographic for a high-level comparison of the two potential models and take a look at our new white paper ‘Trust in the Cloud or Trust in the Phone: Security Fundamentals for Contactless Mobile Payments’.

Ian Hermon, mobile payment security specialist at Thales says

“As an industry we have been talking about the arrival of mobile payments for almost a decade now. Whilst we have seen big players in the retail market, such as Starbucks, invest in mobile payment platforms we are still a long way off from having one universally accepted model. Whether the industry moves to place its trust in the handset or in the cloud, one thing is for certain, the system as a whole will need to be protected from compromise or misuse. Thales is a leader in both the traditional payments ecosystem and in the broader data protection and cloud security markets. Thales hardware security modules (HSMs) are already proven to satisfy the high assurance security requirements of the banking industry and we are therefore exceptionally well placed to help our current and prospective customers implement a comprehensive security infrastructure that embraces both the traditional and the emerging payment worlds.”

For industry insight and views on the latest payment security trends check out our blogs https://cpl.thalesgroup.com/blog