Doug Bies | Product Marketing Manager

More About This Author >

Doug Bies | Product Marketing Manager

More About This Author >

Doug Bies | Product Marketing Manager

More About This Author >

Doug Bies | Product Marketing Manager

More About This Author >

You are shopping online, adding items to your cart, and you're ready to pay with your credit card. You expect that when you hit "Checkout," your payment details will be safe. This sense of trust exists thanks largely to PCI DSS—the Payment Card Industry Data Security Standard.

PCI DSS is a security system for your credit card and its data. Just as you wouldn't feel comfortable if a shop left your credit card information on a sticky note, PCI DSS ensures that businesses treat your payment data with extra care, keeping it encrypted, well-protected, and out of reach from anyone who shouldn't have access to it. So, every time you buy something, PCI DSS is working behind the scenes to keep your financial information safe from digital "break-ins."

According to the 2024 Thales Data Threat Report – Financial Services Edition, 39% of U.S. financial services organizations report that they have experienced a data breach in the past. Even more alarming, 18% reported that they experienced a ransomware attack. Additionally, the IBM 2024 Cost of Data Breach report indicates that financial services tops the list of industry verticals regarding the average data breach cost at $6.08 million.

What is PCI?

The Payment Card Industry (PCI) Data Security Standard (DSS) was established in 2004 by the major credit card brands such as Visa, Mastercard, American Express, Discover, and JCB. The goal was to create a unified set of security requirements for all entities that handle cardholder data.

Why do I need to be PCI Compliant?

PCI DSS compliance is mandatory for financial institutions, online payment processors, merchants that accept payment cards, and any organization that processes payment card transactions, stores or accesses payment card information, and any service providers that enable business anywhere in the card processing ecosystem.

Key Dates

The key deadline for PCI DSS 4.0 was March 31, 2024, when the previous version (PCI DSS 3.2.1) was retired. Compliance with PCI DSS 4.0 is compulsory after this date. However, some of the requirements of PCI DSS 4.0 are flagged as best practice until March 31, 2025, at which point they, too, become mandatory.

Failure to be PCI Compliant

Suppose merchants and service providers fail to comply with PCI DSS. In that case, penalties can include fines ranging from $5,000 to $100,000 USD per month, increased audit requirements, and potential shut down of credit card activity by a merchant bank or credit card brand. These penalties depend on the volume of transactions, the level of PCI DSS that the merchant or service provider should be on, and the time it has been non-compliant.

Thales Solution for PCI Compliance

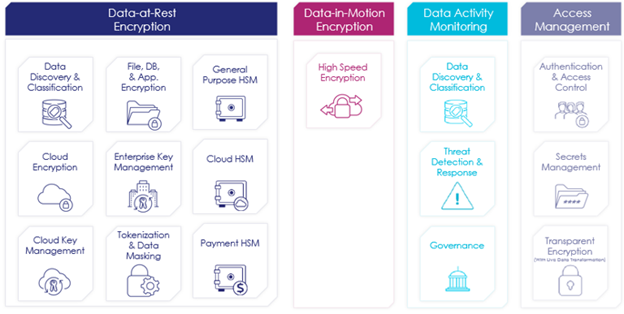

No single tool enables organizations to be 100% compliant, but thankfully, Thales has comprehensive data security solutions that align to PCI requirements. Thales is driven by a vision to protect data and all paths to it, enabling you to become more compliant and more secure. Thales Data Security Platform is pivotal to creating a comprehensive data security strategy with enhanced risk management. It provides visibility to threats in your data and allows you to discover, protect, and control access to your sensitive data anywhere using robust Data Encryption, Key Management, and Hardware Security Modules. PCI compliance made easy.

Thales Top PCI DSS 4.0 Data Security Use Cases

How Thales’s Data Security Platform Helps with PCI Compliance

Data Encryption:

- CipherTrust Transparent Encryption (CTE) delivers data-at-rest encryption at the OS/File-system, database, and application levels. It also encrypts data across multiple clouds, big-data, and container environments. CTE is designed to meet PCI DSS requirements and best practices with minimal disruption, effort, and cost.

Data Masking:

- Thales’s data masking solutions can replace sensitive data with non-sensitive data for testing and development purposes, reducing the risk of exposing sensitive information.

Key Management:

- Thales’s key management solutions ensure keys are kept away from the data. They securely generate, store, and manage cryptographic keys, which are essential for effective data encryption.

Hardware Security Modules (HSMs):

- Thales HSMs provide a highly secure environment for cryptographic operations, protecting sensitive data and cryptographic keys from various threats.

- At Rest: HSMs provide secure storage for sensitive data in a hardened, tamper-resistant FIPS 140-validated device, protecting it from unauthorized access even if the physical storage device is compromised.

Tokenization:

- Thales’s tokenization solutions can replace sensitive cardholder data with unique tokens, reducing the risk of data breaches and simplifying compliance efforts.

Data Governance and Access Control:

- Thales offers solutions to help you implement robust data governance and access control policies, ensuring that only authorized individuals have access to sensitive data.

Security Analytics:

- Thales’s security analytics tools can help you monitor your network for suspicious activity and identify potential security threats.

- Compliance with PCI DSS requirements: Thales security analytics can help organizations comply with PCI DSS requirements related to security monitoring and incident response.

Cloud Security:

- Thales offers cloud security solutions to help you protect their data in the cloud, ensuring compliance with PCI DSS requirements in cloud environments.

Database Activity Monitoring (DAM):

- Detection of unauthorized access: DAM can detect unauthorized access to databases, including attempts to steal sensitive cardholder data.

- Compliance with PCI DSS requirements: DAM can help organizations comply with PCI DSS requirements related to database security.

Data Discovery and Classification:

- Identification of sensitive data: Data Discovery and Classification helps you identify sensitive data that needs to be protected.

- Compliance with PCI DSS requirements: Data Discovery and Classification helps you comply with PCI DSS requirements related to data protection.

With Thales’s solution depth, you can now be PCI compliant without investing in a confusing set of tools through multiple vendors. Thales Data Security Platform continues to add advanced security and compliance features that enable you to address evolving PCI challenges.

Meet PCI Requirements

Thales CipherTrust Data Security Platform is the central point for organizations to become or remain PCI Compliant. Featured in Gartner’s Market Guide to Data Security Platforms, CipherTrust Data Security Platform is an integrated set of data-centric solutions that remove complexity from data security, accelerate time to compliance, and secure cloud migrations. The CipherTrust Platform unifies data discovery, classification, data protection, and centralized management for keys and secrets into a single platform. This results in fewer resources dedicated to security operations, ubiquitous compliance controls, and significantly reduced risk across your business.

Download our comprehensive paper for a complete list of the requirements and how Thales data protection solutions can help you accelerate your time to becoming PCI compliant.