Randy Hildebrandt | Product Marketing, Data Protection

More About This Author >

Randy Hildebrandt | Product Marketing, Data Protection

More About This Author >

Randy Hildebrandt | Product Marketing, Data Protection

More About This Author >

Randy Hildebrandt | Product Marketing, Data Protection

More About This Author >

Secrets management is one of the top DevOps challenges. According to 2024 Thales Global Data Threat Report: Financial Services, FinServ organizations face greater security challenges in securing cloud infrastructure and focus on locking down secrets in development operations. This is a sobering fact. Among respondents who cited cloud/DevSecOps as a top source of emerging security concern, 61% identified secrets management as a top DevSecOps challenge. Let’s look at the role of secrets management for financial services.

The safe handling of private data, including passwords, and other credentials, is known as secrets management. Ensuring the integrity and confidentiality of data is crucial for every firm, but it's especially critical for financial services.

Financial firms manage enormous volumes of sensitive data, such as financial records, transaction details, and customer information. Maintaining compliance with strict regulatory standards and safeguarding this data from unwanted access depend on effective secrets management.

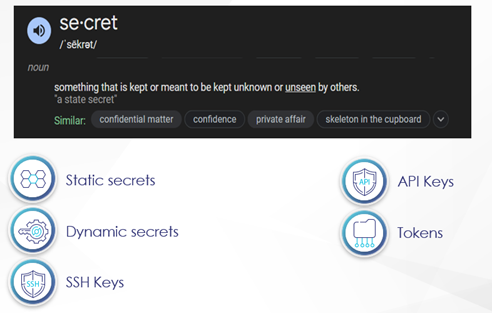

What is secrets management?

Secrets management for any business entails the safe handling, retrieval, and use of confidential data. It includes a range of procedures and instruments intended to safeguard login credentials and guarantee that only approved individuals and systems can access this data.

Access control methods, encryption, and secure storage solutions are important components. These components work together ensuring that secrets are managed securely throughout their lifecycle.

Why is secrets management crucial for financial services?

Financial institutions must safeguard sensitive data preventing breaches and unauthorized access. Effective secrets management helps to protect data both at rest and in transit, reducing the risk of data leaks and fraud. Because secrets management offers safe ways to handle and safeguard sensitive data, it is essential to fulfilling these compliance obligations.

Making sure that only authorized individuals have access to sensitive information is one way that good secrets management lowers the risk of insider threats and cyberattacks. Additionally, it aids in preventing security incidents brought on by credential exposure or poor management.

Financial services must consider the difficulties managing secrets. They often operate in intricate IT environments that include a variety of legacy infrastructure, systems, and apps. Maintaining confidentiality in these various contexts can be difficult and calls for a well-thought-out plan.

Organizations must manage an increasing number of secrets as they expand. It can be challenging to scale secrets management systems to ensure efficiency and security during this expansion.

It's never easy to ensure that secrets are only accessible to authorized people and systems. Incorrectly configured access controls may result in compliance problems and security flaws.

Summary

One essential part of cybersecurity in financial services is secret management. Financial organizations may safeguard confidential information, maintain regulatory compliance, and reduce the danger of unwanted access by managing secrets well. Establishing strong secrets management procedures should be a top priority for financial organizations to protect their operations and improve their overall security posture.

Thales is a trusted brand in the finance industry. Visit our financial services page for information on managing secrets. Keep a lookout for an upcoming article where we'll examine some tactics and industry best practices for putting efficient secrets management into practice for financial services.