CBDC, or Central Bank Digital Currency, is a trending topic in the financial industry. Let's examine the basics of CBDC and its impact on the economy. As many Thales Accelerate Partners are actively involved in CBDC projects, it's important to understand the basics of this digital currency and see why cooperation with Thales is beneficial.

Part 1 – what CBDC is all about

There is a constant development and progression of payment methods and systems over time. This includes the evolution from physical currency and checks to digital payment methods such as credit and debit cards, as well as the emergence of newer technologies like mobile payments and cryptocurrencies.

Many Thales Accelerate Partners are deeply involved in the CBDC projects so lets take a look first at what CBDC is.

CENTRAL BANK DIGITAL CURRENCY OR CBDC IS A DIGITAL MONEY,

AN ELECTRONIC VERSION OF NOTES AND COINS.

Central Bank Digital Currencies (CBDCs) are an important step towards a cashless society and a means of enabling digital payments for all citizens. CBDC will complement cash and be accessible to the general public for transactions using various devices.

Key CBDC benefits

- Remove costs of cash

- Remove banking & intermediary transaction costs with instant settlement

- Non-volatile currency, £10 CBDC = £10 physical banknote

- Sovereignty, national security

- Enabling cashless society with financial inclusion for everyone

CBDCs are not Cryptocurrecies

Central bank digital currencies are digital versions of a country's national currency that are issued and backed by the central bank of that country. They are designed to be used as a means of payment and can be used in the same way as physical cash or traditional bank deposits. CBDCs are distinct from cryptocurrencies like Bitcoin and Ethereum, which are decentralized and not issued or backed by a central authority.

Overall, CBDCs as a new type of digital currency are not volatile like cryptocurrencies. As explained by the Bank of England[1] “£10 of a UK digital currency would always be worth the same as a £10 note”.

Payments evolution and a CBDC origin

One of the fairly recent and significant evolutions in digital payments was introduction of open banking that has increased competition and innovation in the financial sector. Open banking is a good indicator of the speed and extent to which consumers and businesses are adopting new payment technologies.

As the use of cash decreases and digital payments increase, there has been growing interest in cryptocurrencies and digital assets. Stablecoins are digital assets that are designed to maintain a stable value relative to a specific asset, such as the US dollar or gold. The goal of stablecoins is to provide the benefits of digital currencies, such as fast transaction times and low fees, while avoiding the volatility that is typically associated with cryptocurrencies like Bitcoin and Ethereum.

Overall, stablecoins are generally considered to be less volatile than other cryptocurrencies, but the degree of volatility can vary depending on the specific type of stablecoin and the market conditions.

In response to these developments, central banks are exploring the possibility of issuing their own digital currencies, known as central bank digital currencies (CBDCs), which could offer the safety, robustness, and efficiency of payments in developed countries and promote financial inclusion in emerging economies.

Why is Financial inclusion an important benefit of CBDCs

CBDCs have gained widespread popularity due to their potential to promote financial inclusion as well as significantly simplifying digital payments.

By allowing anyone to make electronic payments using central bank-issued money, CBDCs provide an alternative to traditional banking systems. This is especially useful for those who do not have a bank account, as they can still participate in digital financial transactions through peer-to-peer payments with CBDCs.

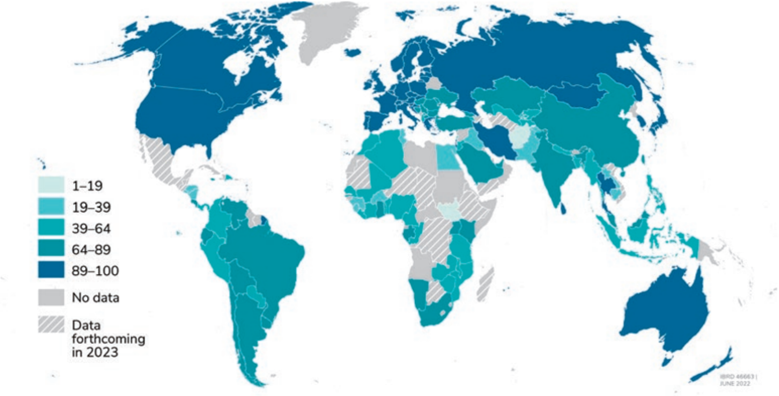

According to the World Bank account ownership rates vary across the world. Even in regions like Europe a lot of Citizens do not have a bank account:

Source: World Bank Findex 2021 report

Global CBDC initiatives

Central banks are responsible for promoting monetary and financial stability in the best interests of the public. In order to address the challenges posed by cryptocurrencies and decentralized finance (DeFi) to traditional payment systems, central banks are exploring the use of CBDCs. They exists in either Token Based (object of value) or Account based (value stored at the Central Bank) form and are of two types, wholesale CBDCs and retail CBDCs.

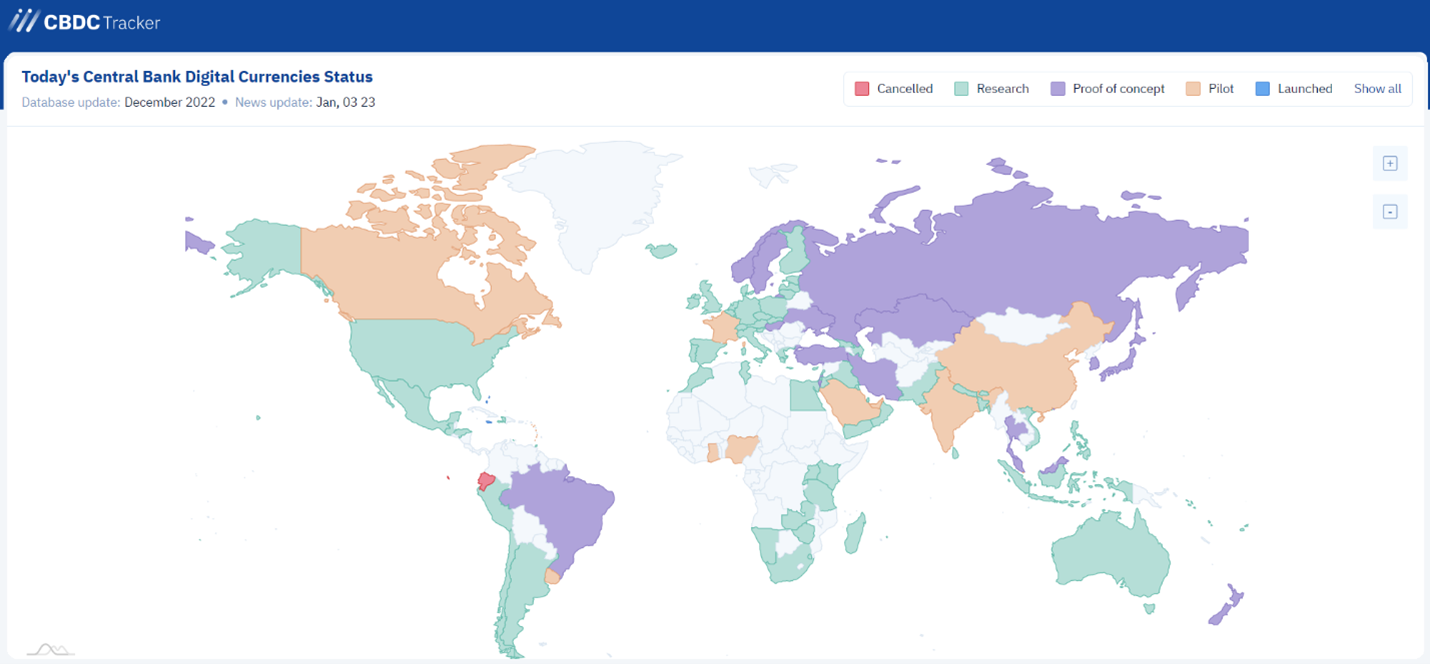

More than 130 Central Banks have been exploring CBDCs since 2014.

It is challenging to keep track of the various developments and updates in the field of CBDC as numerous countries are exploring and implementing their own versions. New information about this topic is constantly emerging from different sources, making it difficult to track the status and analyze historical trends [2]. One of the best resources for the collected data is the CBDC Tracker:

CBDCs are still in the experimental phase in many countries and are not yet widely available. Some countries, such as China and Sweden, are actively exploring the possibility of issuing a CBDC, while others, such as the United States and the European Union, are taking a more cautious approach.

CBDC Benefits

With the introduction of CBDCs there are multiple benefits for Consumers, Government &Central Banks and other Financial institutions. However, CBDCs are mainly driven by the Central Banks.

For a CBDC to be successful, it must be widely adopted by users. In order to achieve this, the CBDC must offer features or benefits that make it appealing to users and competitive with existing payment methods. In order to be thriving, a CBDC must also demonstrate that it is reliable and effective as a means of payment.

1. Government & Central Banks

Central banks are exploring the use of central bank digital currencies as a way to take advantage of the benefits of cryptocurrencies for economic growth, while also minimizing the potential risks to financial stability:

1. Improved financial inclusion: CBDCs can make it easier for people to access financial services, especially in areas where there is limited access to traditional banking infrastructure.

2. Greater financial stability: By providing an alternative to physical cash and removing the need for other cash substitutes, CBDCs could reduce the risk of bank runs and other types of financial instability.

3. Enhanced cybersecurity: CBDCs could be more secure than physical cash or other traditional payment methods, as they can be designed with advanced security features.

4. More data for policymakers: The use of CBDCs could provide central banks with more data on economic activity, which could help them make more informed policy decisions.

2. Consumers

CBDCs can offer several benefits to consumers, including:

1. Improved financial inclusion: CBDCs could make it easier for people to access financial services, especially in areas where there is limited access to traditional banking infrastructure.

2. Enhanced convenience: CBDCs can be accessed and used digitally, which could make it easier and more convenient for people to make transactions.

3. Efficient transaction settlement: CBDCs can reduce the cost and time required to process transactions, as they can be settled digitally in real-time.

4. Greater security: CBDCs could be more secure than physical cash or other traditional payment methods, as they can be designed with advanced security features.

5. Increased interoperability: CBDCs could be used across national borders and across a wide range of payment platforms, which could make it easier for people to make international payments and to use different payment systems.

6. Reduced transaction costs: CBDCs could reduce the cost of making transactions, as they could potentially eliminate fees associated with traditional payment methods such as credit card processing or wire transfers.

3. Banks & other financial institutions

The introduction of CBDCs may increase competition in the payment space, potentially forcing banks to innovate and improve their own digital payment offerings.

There are a number of potential benefits that CBDCs could bring to banks:

1. Improved efficiency: CBDCs may enable faster and more efficient payment processing, potentially reducing the costs associated with certain types of transactions.

2. Enhanced financial stability: By providing an alternative to physical cash and potentially reducing the reliance on certain types of intermediaries, CBDCs may help to improve the stability of the financial system. This could ultimately benefit banks by reducing the risk of financial instability.

3. Greater financial inclusion: CBDCs could make it easier for people to access financial services, potentially increasing the number of customers for banks.

It is important to note, however, that the specific benefits of CBDCs for banks will depend on a variety of factors, including the specific design of the CBDC and the adoption of the CBDC by consumers and businesses.

CBDC requirements

Primary concern of CBDC implementation is Security. No CBDC implementation can succeed if there is any doubt in security of its infrastructure, digital tokens and its storage or transactions.

Examples of other CBDC features include Wide-availability, Convenience, Low cost, Instant settlement, Offline capabilities, Cross-border payments, Cap or a Limit on indivitual holdings, Scalability, Compliance with Anti-money laundering.

CBDC has to be Highly Secure, Trustworthy, Privacy protecting and Resilient. We acchieve those with the use of Cryptography to sign and encrypt information which requires secure storage and operational environment for the cryptographic keys and data (e.g. HSM, mobile Secure Element, Smart Card).

There are many technical, political, and other considerations that must be taken into account when implementing a central bank digital currency. As a result, there are numerous challenges that must be addressed in order for a CBDC to be successfully introduced.

Part 2 coming soon

In the next blog, we will look at some interesting features of CBDC like Offline CBDC and explain about benefits cooperation with Thales brings in the CBDC projects.

Marko Bobinac | Director of Business Development

Marko Bobinac | Director of Business Development