Identity Solution for Admiral - UK's Car Insurer - Case Study

A scalable identity solution

As a fast-growing organisation, Admiral needed a secure and customer-friendly identity solution that was also scalable, so it could manage different brands and work across multiple touchpoints. It also wanted to unify identities across all customer resources.

The solution would have to include a frictionless migration plan for existing customers, as well as full support for online registrations. Many of those registrations enter the sign-up process through thirdparty price comparison sites. Not all of them wind up becoming customers, which means Admiral requires flexible technology as well as a flexible licensing model.

5,600,000

Cars insured

1,000,000

Home & travel insured

17

Brands

10

Countries

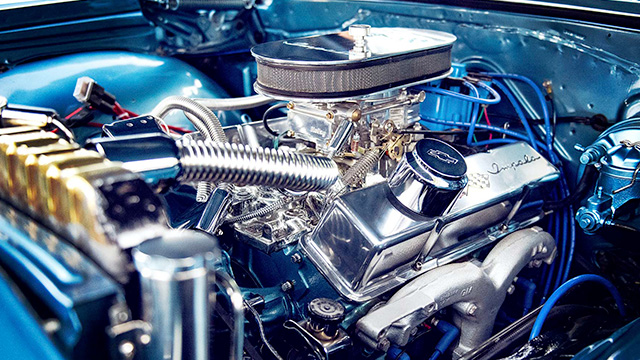

One engine for all brands

There are 3 different ways in which Admiral onboards prospects and customers online into its Customer Identity and Access Management (CIAM) framework.

- Through its various brands (each using its own price quoting module), all connected through OpenID Connect

- Through registration processes for existing customers on the website (with lookup functionality for insurance policies)

- Through third-party price comparison sites such as Confused.com and Independer

After onboarding, Admiral manages the new prospect’s identity in its identity store for all user types, with a flexible data model, including metadata to ensure compliance to new privacy regulations and British ICO guidelines.

The option of a unique attribute that can be used for identification, plus a Single Sign-on mechanism ensures a smooth customer journey across devices. This is in line with Admiral’s ambition of being a frontrunner in offering frictionless digital services to its customers. The company is also planning to improve the mobile experience by offering all functionalities in a single app. Additionally, this will enable passwordless online interaction for its customers.

Business users

In addition to serving customers directly, Admiral white-labels its insurance products and offers them to customers through insurance agents such as British AA and Ford Insure. That means the agents need to be able to access Admiral’s identity store and exchange information as business users.

This requires extra delegation options, as staff from the AA and Ford need to access the identity platform and manage identities for prospects and customers under their care. As a result, the CIAM system must not only meet Admiral’s security requirements but also those of the partner organisations.

The Thales OneWelcome Identity Platform is used by internal stakeholders as well with specific identity data solely accessible to those who have the proper rights and permissions; for example, a DPO that needs to download a total data overview or a customer service employee who helps resetting a password.

API-first

APIs play a crucial role in Admirals identity infrastructure. With the number of customer touchpoints across platforms and brands, it is a huge challenge to bring everything together.

The Thales OneWelcome Identity platform and our developer-friendly APIs enable Admiral’s agile teams to integrate new services and apps themselves. Now, they can manage all of the millions of users, no matter which onboarding flow they originate from or which platform they log into.

The UK’s best car insurer

Admiral has earned a strong reputation as the best car insurer in the UK for 6 years in a row. The company started out in 1993, aiming to offer lower prices to a bigger customer base without compromising on the quality of its service or products. It’s been rapidly gaining market share ever since. Though mainly known as a car insurance company with multiple brands and price ranges, Admiral also offers coverage for holidays, pets and even life.

Every 12 seconds a new customer joins Admiral or one of its brands. A seamless online experience is essential to get new and retain existing customers, because the company interacts and does business directly and digitally with its customers. That’s why Admiral is continually optimising its effective sales and quote funnels for each of its brands. Each brand targets a different audience, offering a customised user experience.

© Thales - October 2023