Prime Factors Bank Card Security System (BCSS) powered by Thales payShield 10K

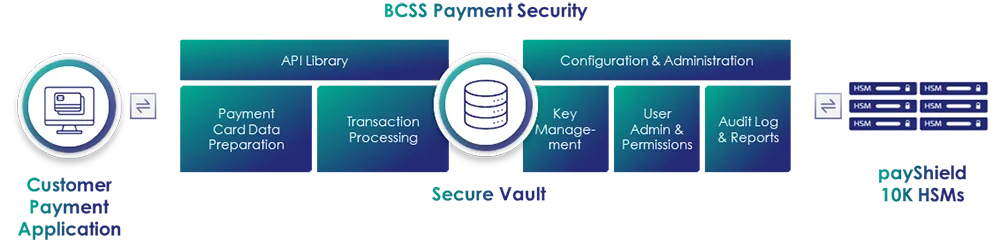

BCSS was built to simplify payments security. Role-based access controls define and enforce separation of duties. Robust payment key management functionality streamlines cryptographic key management and speeds up issuance and processing. Detailed audit logging and reporting functionality helps to comply with industry requirements and pass PCI audits. Importantly, pre-tested integrations with the Thales payShield 10K payment HSMs allow for easy integration, load-balancing and management.

BCSS works exclusively with Thales payShield HSM technology to meet the latest logical security requirements of the leading payment brands including American Express, Discover, JCB, Mastercard, UnionPay and Visa. With Prime Factors BCSS and Thales payShield HSM technology, payment card issuers, personalization bureaus, and payment processors can get to market faster and respond more quickly to change, whether it’s new security requirements or new card applications supported by the HSM firmware.

Bank Card Security System (BCSS)

Helps developers build more secure payment applications faster

BCSS is an application middleware that delivers the critically important elements needed in payment applications to meet industry and regulatory compliance out of the box. Capable of running in both on-premises and cloud environments, BCSS provides the building blocks to simplify integration between a custom payment application and one or more Thales payShield HSMs.

When an organization makes the strategic decision to develop their own payment application, BCSS helps get to revenue faster with less development costs, while reducing overall risk and providing a high degree of future-proofing that enables quick responses to industry changes and hardware updates without complex application redevelopment.

BCSS out-of-the-box functionality includes:

- Hundreds of pre-built workflows to simplify interfacing with payShield HSMs

- Secure key vault to organize and protect payment keys, certificates, and other payment parameters

- Robust payment key management to generate, assign, rotate, revoke, and manage application keys and exchange payment keys

- Granular role-based access controls to enforce separation of responsibility and govern permissions

- Forensic-level audit logging and reporting that has stood the test of PCI auditors for decades

- Configurable load balancing across HSMs on premises or in the cloud

- Functional partitioning to better organize payment keys and parameters to simplify programming

Bank Card Security System (BCSS) powered by Thales payShield - Business Brief

Bank Card Security System (BCSS) is an ideal complement to the Thales payShield 10K, helping deliver critical security elements needed for custom payment applications to meet industry compliance out of the box.

Cut Complexity, Cost, and Risk in Payment Security with BCSS - Webinar

Bank Card Security System (BCSS), powered by Thales payShield HSMs, helps accelerate payment app development, stay audit-ready, and reduce compliance complexity with out-of-the-box security functionality and pre-built workflows. Watch the webinar to learn more!

Top 10 Reasons Payment Leaders Choose BCSS with Thales payShield 10K HSMs - Data Sheet

Modern payment environments demand speed, security, and continuous compliance, but building and maintaining these capabilities in-house increases risk and complexity. This Top 10 guide explains how Bank Card Security System (BCSS), powered by Thales payShield 10K HSMs, simplifies payment security, accelerates time-to-market, and embeds PCI-proven controls from day one. A must-read for organizations modernizing card payment operations without compromising trust or audit readiness.