Danny de Vreeze | Vice President, Identity & Access Management

More About This Author >

Danny de Vreeze | Vice President, Identity & Access Management

More About This Author >

Danny de Vreeze | Vice President, Identity & Access Management

More About This Author >

Danny de Vreeze | Vice President, Identity & Access Management

More About This Author >

As digital transformation continues to redefine the financial landscape, the security and integrity of identity management take on ever-greater importance. At Thales, ensuring trust at every customer, partner, and workforce touchpoint is our highest priority. Today, I am excited to introduce our 2025 report, "Identity and Access in Banking, Financial Services, and Insurance: The Change Imperative," a benchmark study that unpacks the challenges and opportunities ahead.

Why This Report Matters

This research delivers insights gathered from 475 top IT and security decision-makers in banking, insurance, investments, and fintechs across the US, UK, and Singapore. Their perspectives paint a compelling picture of an industry at a crossroads—facing unprecedented digital identity growth, regulatory vigilance, and ever-more sophisticated threats. The findings illuminate not only what must change, but also how forward-thinking organizations can transform these challenges into a competitive advantage.

Highlights: What Every Financial Industry Leader Needs to Know

1. Surging Identity Growth

- Customer identities are projected to rise by nearly 74% in the next 12 months.

- One in five organizations expects their customer identity count will more than double—signaling a groundswell in digital services uptake and heightened expectations.

2. ROI, Complexity and the Multivendor Dilemma

- Organizations currently rely on about four vendors for each identity stack: workforce and customer identity solutions.

- 89% report an urgent or moderate desire to consolidate these environments to reduce operational complexity, cost, and risk.

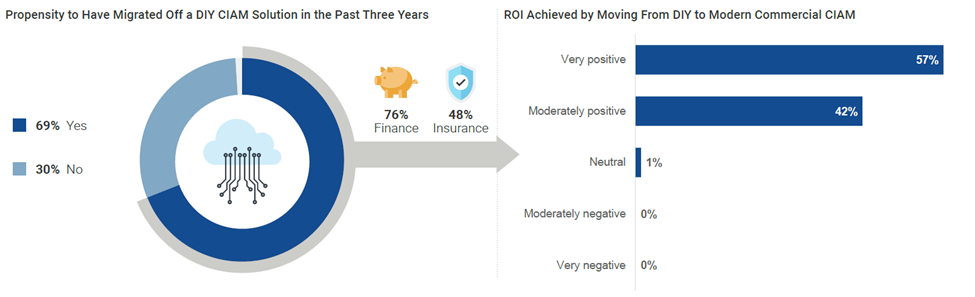

- Migrating off from a DIY Customer Identity Solution to a modern, commercial, CIAM platform has resulted in positive ROI impact for 99% of the respondents

3. Partner and Contractor Risk is Escalating

- Third-party identities will grow by 37% over the coming year. Partners, contractors, and suppliers now require broader, risk-managed access to critical data and apps.

- C-level executives estimate even faster third-party identity growth than operational staff—highlighting a communication gap that must be bridged for effective risk management.

4. A Paradigm Shift: Identity as a Profit Center

- 42% of organizations see their customer identity stack as a profit center, versus just 32% viewing it as a pure cost—reflecting identity’s growing strategic role.

5. Budget Commitment in Uncertain Times

- The majority expect identity security budgets to increase by more than 10% in the coming year, even amid broader economic caution.

- Identity security is now central to innovation, compliance, and business continuity.

6. The Call to Modernization

- 93% have prioritized modernizing workforce identity, and 89% have similar mandates for third-party access solutions.

What Sets This Study Apart

Our survey brings to light the real-world disconnects—between leaders and frontline teams, between complexity and the urgent desire for consolidation, between seeing identity as a cost and seeing it as a driver of business value. As we move into the next era, the firms that thrive will be those investing in modernization, automation, and partnership with trusted security providers.

The Path Forward

This report is more than a survey; it is a roadmap for building resilient, trusted digital experiences. By investing in robust, unified identity solutions, organizations can manage risk, delight customers, and stay ahead of evolving threats. As a senior leader at Thales, I invite you to explore the detailed insights and recommendations within this report, equipping your teams to build a future that is secure and full of promise.

Download the full Thales 2025 Identity & Access in Banking, Financial Services & Insurance Report to unlock actionable recommendations and join the leaders shaping tomorrow’s financial security.