Introduction

It's no secret that profitable growth is a primary goal of most companies. Expanding earnings from existing customers is at least as important as acquiring new ones. At the core of that goal are two techniques: upselling and cross-selling.

Discover how upselling and cross-selling drive profitable growth. Learn who to sell to, how to package and price to drive upsell and cross-sell, and why leading enterprises are moving to Portfolio Monetization to scale revenue across their all product lines.

What Is the Difference Between Upsell and Cross-Sell in Software

Understanding the cross-selling and upselling difference is fundamental to building effective expansion strategies. While both approaches drive revenue growth, they target different customer needs and require distinct approaches.

What Is Cross-Selling?

B2B cross-selling is the practice of offering customers additional, complementary software products or services that enhance their existing purchase. Cross-selling expands value by broadening product portfolio use.

To be successful with cross-selling, you can employ two methods.

The first method is to expand your product line by offering new products or services that naturally complement what you already sell. Think of Amazon suggesting a phone case when you buy a phone, or a coffee shop adding pastries to go with their drinks. For software companies, this might mean a contractor management platform adding time tracking or invoicing tools that naturally fit their customers' workflows. These are "adjacent" offerings that make sense alongside your core products.

The second method is to bundle existing products strategically. Rather than creating new products like in the first method, you work with the features and modules you've already built. For example, that same contractor management platform might already have features for onboarding, compliance tracking, payment processing, and communication. Instead of selling one comprehensive package, you could create a "Compliance Bundle" for operations teams focused on contractor verification and document management, a "Finance Bundle" for accounting teams centered on payment and invoice features, and a "Team Collaboration Bundle" for project managers who need contractor communication and task assignment tools. Each bundle uses existing functionality but is packaged to address a specific use case. Doing this highlights a unique value proposition for different customer segments, and allows you to easily cross sell from one to the other.

Effective cross-selling strategies in B2B software require careful attention to customer workflows and pain points. B2B cross-selling succeeds when new products solve adjacent problems your customers face.

Examples of Cross-Selling Strategies:

- Selling analytics dashboards or reporting tools to customers who already rely on your operational software.

- Introducing security, compliance, or backup modules to customers managing sensitive data.

- Offering training packages or professional services to increase time-to-value.

These cross-selling techniques create natural expansion paths that feel helpful rather than forced.

What Is Upselling?

Upselling is a business strategy that encourages a customer to upgrade their order to higher-tier plans, expanded feature sets, increased limits, or larger user capacity. This deepens customer engagement with a solution they already trust.

To be successful at upselling, companies need to identify the right value metric. Unlike cross-selling, where you're offering additional products or bundles, upselling means moving customers to a higher tier of the same product. The key is choosing a metric that aligns with how customers actually experience your product's worth.

For example, say your contractor management platform charges per active contractor in the system. As a customer's business grows and they need to manage more contractors, they naturally hit their limit. The upsell becomes obvious: pay more to manage more contractors. But this only works if the product's value actually scales with the number of contractors managed.

If your platform's real value comes from something else—like the number of compliance checks run each month or the payment volume processed—then your pricing should reflect that instead. When the value metric matches how customers use and benefit from your product, upselling happens organically as their needs expand.

Examples of Upselling Strategies:

- A growing company increasing user seats after outgrowing initial purchase

- A usage-based customer exceeding thresholds and transitioning to a higher-volume package

- A customer on a “Standard” plan upgrading to “Enterprise” to access role-based controls or premium support

These product upselling examples demonstrate how value-aligned pricing creates intuitive upgrade paths.

Four Key Strategies To Drive Upselling and Cross-Selling in B2B Software

Strategy One: Identify Who To Upsell and Cross-Sell To

Pinpoint Expansion-Ready Accounts with Product Usage Data

The key to deciding who to target for upselling and cross-selling is understanding how customers use your product. You need to track which features customers use and how often they use them. These usage patterns, combined with other signals like support tickets, feature requests, or account expansion, can help you identify customers who are ready to buy more.

For smaller companies, spotting opportunities is straightforward. You might notice a customer hitting a usage limit, requesting access to premium features, or adding new team members. Your customer success team can catch these signals naturally through regular conversations. With a handful of accounts, you can stay on top of what each customer needs.

Larger companies face a different problem: they're drowning in data but starving for insight. Each enterprise account might have dozens or hundreds of users across different departments. One team might use the product heavily while another barely logs in. A spike in activity could signal genuine interest in upgrading, or it could just mean one person is testing features they'll never actually adopt. Without the right tools, separating meaningful buying signals from random noise becomes nearly impossible.

The consequence is real. Sales and customer success teams miss revenue opportunities because they can't see who's ready to buy. They might reach out too early when a customer isn't ready, or too late after a competitor has already filled the gap. Many teams rely on basic CRM data and renewal dates, but they can't see how different teams actually use the product or which features those teams adopt. Without this visibility, teams resort to guesswork when identifying upselling and cross-selling opportunities.

These Product Usage Data Points Signal Upsell and Cross-Sell Opportunities

Clear, data-driven indicators help your sales, success, and product teams engage at the right moment, with the right offer.

Here are some of the most reliable signals to watch for:

- Usage Limits or License Overage Reached

- When customers regularly hit seat, usage, or feature limits, you know that i they’re ready to move to a higher tier or volume package.

- Full Entitlement Utilization

- A customer activating everything that was in their entitlement prior to renewal time signals strong value recognition and the potential to upgrade them.

- Low Adoption of Related Products or Product Lines

- Your portfolio may include more products that could be valuable to a specific customer. You can uncover whitespace by understanding the cross portfolio or cross product line adoption.

- Early Signs of Customer Disengagement

- While not a cross-sell trigger, if a customer is not deploying the products they purchased or not activating specific features, you can step in with a well-timed re-engagement plan.

Missing Growth Targets?

Stop Guessing.

Start Getting Data In Your CRM.

Explore Sentinel Pulse, a powerful solution that provides account-specific product engagement insights within Salesforce, empowering sales teams to drive upsell opportunities, reduce churn, and maximize customer lifetime value.

Strategy Two: Designing Product Bundles That Make Cross-Selling a Natural Next Step

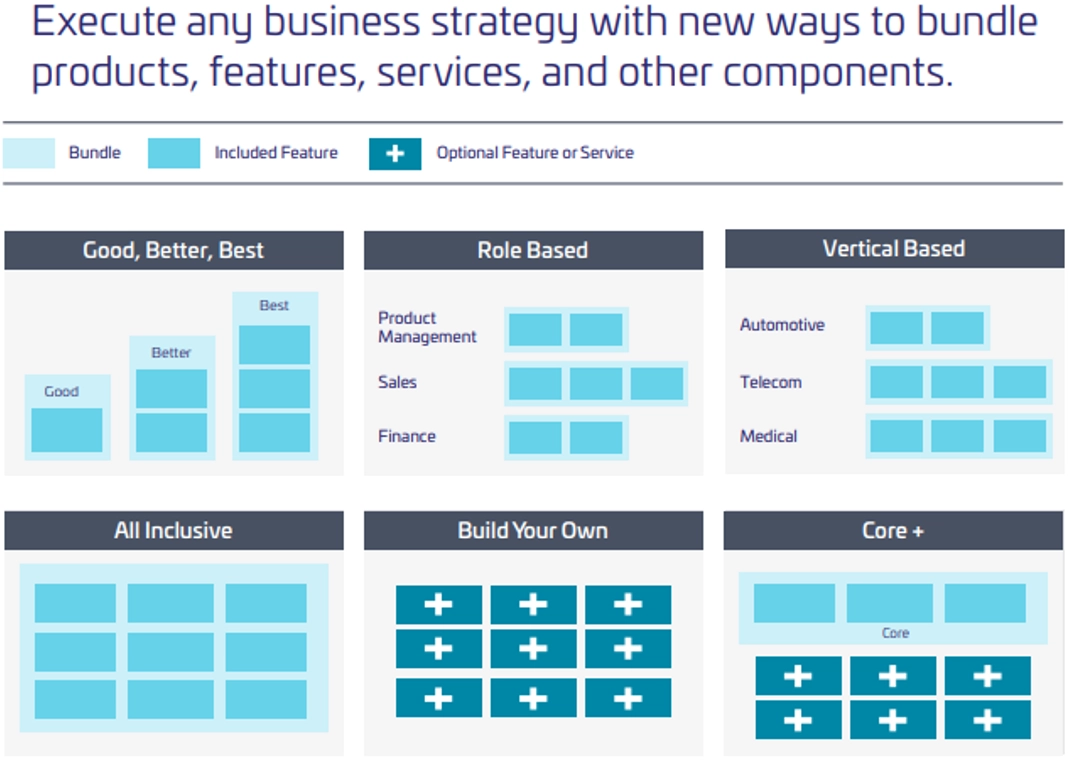

Packaging does two things. It makes the product easy to understand. And it shows customers that you understand them. Bundling features, capabilities, and add-ons into sellable units creates structure and indicates you are thinking in a customer-centric way.

For example, offering a plan for teams of 0- 10, tells startups you’ve thought about their needs. An enterprise plan tells larger buyers you’re ready for scale. When you get packaging right, you open the door to cross-sell because customers can clearly see how purchasing a different part of your portfolio will help them further their goals.

Bundling related capabilities—like analytics with security, or storage with product management—helps customers understand the value of various product capabilities. From there, it’s easier to show them what else they might need, making cross-sell feel organic, not forced when customers see the logic. They recognize the added value that makes the cross sell natural.

Strategy Three: Find the Right Value Metric to Make Upselling Intuitive and Frictionless

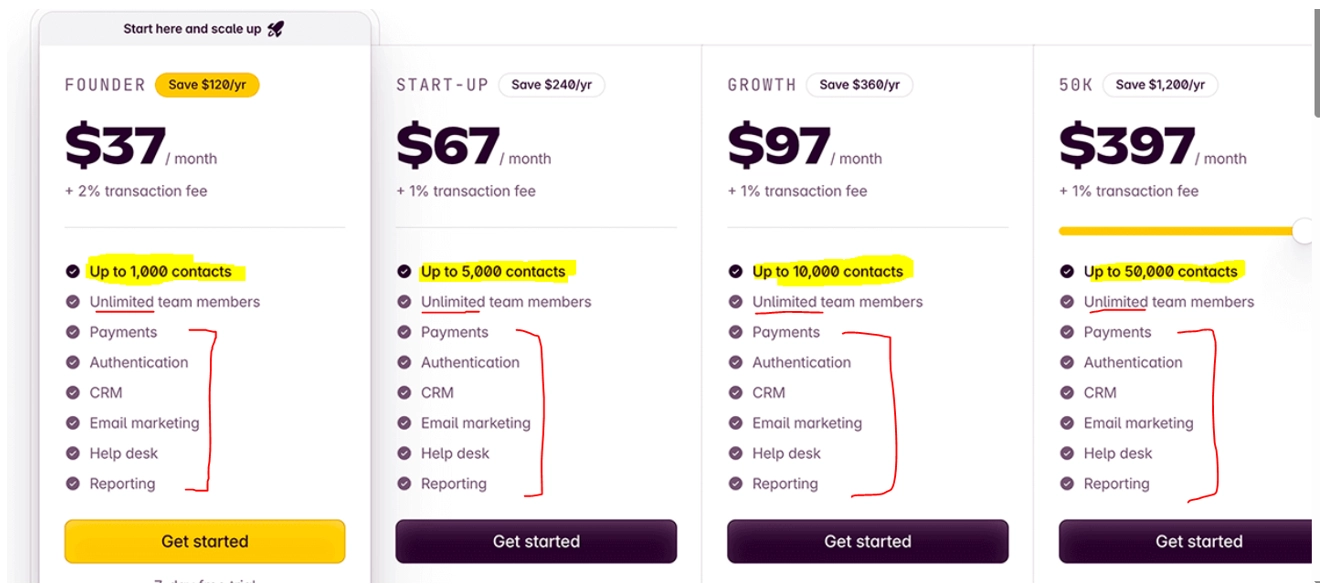

Compared to cross selling, which centers around complementary products and features, upselling is often about usage and the value metrics that track it. The value metric is what your pricing is built around—number of users, length of documents, quantity of API calls, credits, volume of data. Tracking and pricing that value metric correctly can unlock upselling opportunities, making it intuitive for your user base. But first, you have to find a value metric that feels so logical customers don’t think twice about upgrading.

In this example, Outseta is monetizing the number of contacts each account can store in the platform. The number of contacts was the metric they chose to monetize, as opposed to number of seats, users, or volume of usage. For this product, the value comes from how many contacts you have in the system. Creating an offer based on that metric makes for an easy upsell.

Strategy Four: Establish More Paths for Upsell and Cross-Sell With Hybrid Pricing Models

Some products deliver value in more than one way. In those cases, a single value metric might not be enough. That’s where hybrid pricing models come in.

Hybrid models combine different ways of charging. For example:

- Charge a flat fee for access (e.g., per user),

- Then add usage-based pricing (e.g., per scan, per GB),

- Or let customers buy credits they can spend across features or teams.

This gives you more flexibility. It also gives customers more choice. Light users can start small. Power users can scale without friction. And you create multiple expansion triggers—not just one. These flexible upselling strategies work particularly well when combined with thoughtful cross-selling techniques.

Bonus Strategy: Portfolio Monetization For Enterprise Upsell and Cross-Sell

In smaller or single-product environments, upselling and cross-selling are effective strategies for driving expansion. They allow vendors to deepen customer adoption and introduce complementary capabilities, often with minimal coordination or infrastructure.

In large enterprises, however, these approaches face significant limitations. Customers interact with multiple products, teams, and contracts—often across global regions and business units. Expansion becomes more difficult to execute and even harder to manage consistently. B2B cross-selling at enterprise scale requires systematic approaches beyond traditional sales motions.

Portfolio Monetization Provides a Scalable Framework for Enterprise Growth

Portfolio Monetization addresses these challenges by introducing a strategic, system-level approach to enterprise-scale expansion. At its core, Portfolio Monetization is packaging, distributing, and tracking multiple product lines with a cohesive commercial strategy—designed specifically for complex, multi-departmental enterprise environments. It involves balancing flexible offerings that meet broad organizational needs with streamlined visibility through centralized systems like CRMs or EMS platforms.

By designing packages with complex enterprises in mind, companies can move beyond isolated product growth and toward unified monetization across the entire portfolio. Instead of managing upsell and cross-sell as individual motions within separate product lines, Portfolio Monetization establishes a commercial framework that spans:

- Multiple SKUs and packaging tiers

- Distinct but related product families

- Cross-functional enterprise use cases

- Global customer segments with varied buying needs

When these structural issues are addressed, upsell and cross-sell motions become easier to execute—no matter how complex the customer or product portfolio. Portfolio Monetization turns ad-hoc growth into a repeatable, scalable strategy that drives consistent expansion across the full enterprise customer footprint.

When enterprises sell into other enterprises, this is portfolio monetization is often implemented through Enterprise License agreements. ELA’s provide a fixed-budget, flexible-consumption model that simplifies procurement and encourages broad product uptake—particularly when buyers have the authority to drive cross-departmental adoption.

However, a well-structured Portfolio Monetization strategy goes beyond Enterprise License Agreements, combining smart pricing, aligned go-to-market efforts, and smooth execution to drive growth and value. It also enables smaller bundles that, while not ELA-sized, effectively serve targeted market segments.

If Growth Creates Complexity, Revenue Suffers

Unify your offerings. Simplify purchasing. Sell across your portfolio without bottlenecks.

Learn how leading software companies remove silos and accelerate revenue with Portfolio Monetization.

Conclusion: Driving Profitable Growth Through Smarter Upselling and Cross-Selling

Expansion revenue is the most efficient path to growth for today’s enterprise software leaders. And it starts with smarter, data-driven upselling and cross-selling.

Ready to unlock more expansion revenue across your software portfolio? Talk to our team or Explore Thales Sentinel’s entitlement and monetization solutions.

Frequently Asked Questions

Both upselling and cross-selling strategies drive expansion revenue, but they each require different packaging, pricing, and entitlement approaches. Understanding the cross-selling and upselling difference helps teams execute each motion effectively.

Upsell is encouraging customers to upgrade to a higher-tier product or add premium features for greater functionality. Cross-sell is promoting complementary products that add value to their existing purchase. Both upselling and cross-selling strategies drive expansion revenue, but they each require different packaging, pricing, and entitlement approaches.

Product usage data helps identify customers ready to upgrade (upsell) or adopt adjacent products (cross-sell), driving targeted, data-backed offers that increase revenue per account. This data forms the foundation of an effective upselling and cross-selling strategy.

Sentinel’s product catalogue allows you to bundle products, features, and components into unique packages that align with customer needs while creating clear upgrade paths and cross-sell opportunities.

Because the Sentinel platform allows you to create packages without code changes, Sentinel allows you package and price offerings in ways that align with customer needs while creating clear upgrade paths and cross-sell opportunities.

Sentinel manages entitlements at a granular level, ensuring customers only access what they’re licensed to use. Through integration with your product UI or through Sentinel’s customer portal, customers can clearly see available licensees, what’s been deployed, and what’s included in their packages.

Sentinel supports multiple value metrics, including usage-based, user-based, device-based, or hybrid models. You can align pricing to customer-perceived value, then operationalize it seamlessly through entitlements, license enforcement, and integrated usage tracking for billing and insights.

Yes, Thales Sentinel supports hybrid pricing models. You can combine subscriptions, usage-based charges, user-based fees, and feature-based tiers into flexible pricing structures that align with customer value and maximize revenue. Sentinel EMS manages entitlement configurations for these models, while Sentinel LDK enforces them and then delivers real-time alerts in your CRM. These capabilities are essential for B2B cross-selling at scale.

Thales Sentinel supports upsell and cross-sell in complex enterprise accounts by providing multi-level visibility into license adoption across divisions and business units, highlights where upgrades or additional products will drive the most value and delivers real-time alerts in your CRM.

Sentinel Pulse integrates product engagement insights directly into your CRM like Salesforce or Dynamics, showing: risk). Sales teams can prioritize accounts, tailor outreach, and drive expansion confidently without leaving their CRM.

- Account-level usage summaries

- Entitlement consumption data

- License activation trends

These insights highlight customers who are highly engaged (ideal for upsell/cross-sell) or under-utilizing licenses (potential churn risk). Sales teams can prioritize accounts, tailor outreach, and drive expansion confidently without leaving their CRM.