Dale Hopkinson

Senior Product Manager

Just as software revolutionized entire sectors with digital transformation, Artificial Intelligence (AI) promises to reshape all markets. However, unlike the early days of the software and SaaS booms, today's businesses know they need to prioritize financial accountability early on.

AI development carries a significant cost burden, from initial implementation to ongoing operations. Pressure for measurable Return on Investment (ROI) from C-Suite executives and investors is intensifying. At the same time, only 58% of companies that have launched AI products or features are monetizing AI.

Effectively monetizing AI requires a strong strategy and the right monetization systems. Only then will companies be able to realize new revenue streams from AI and accelerate ROI.

The Cost Dynamics in AI are Inherently Challenging

In contrast, traditional software and SaaS models tend to scale efficiently. As user numbers increase, revenue typically grows proportionally. With AI, this assumption is less certain.

AI requires substantial investments in research, skilled personnel, and the technical infrastructure necessary to maintain its operations. On average, companies investing in AI incur 20% higher R&D expenses. Furthermore, AI products present a unique Catch-22: usage is tied to substantial incremental costs because the more your AI product is used, the higher your operational expenses costs.

Understanding the costs in AI highlights why having a well-defined AI monetization strategy is so important.

The Hidden Cost Drivers in AI

Computing Costs

AI development often requires significant investment in high-end computing hardware, such as GPUs and TPUs, which are essential for training complex machine learning models. While this is accounted for, there will be ongoing costs associated with cloud services like AWS, Azure, or Google Cloud Platform.

Data Acquisition Costs

Obtaining high-quality, relevant data sets for machine learning training can be expensive, whether you need to purchase access to labeled data or dedicate resources towards in-house data labeling. Bloomberg, for example, invested over $10M to develop a Large Language Model (LLM) tailored for financial tasks based on its own curated data and third-party data.

Model Optimization Costs

This is a large upfront and ongoing cost that is needed to ensure the models you use are delivering the expected performance. Cost is associated with improving response accuracy, training, and fine-tuning models.

Licensing Large Language Models (LLMs)

Utilizing existing capabilities like OpenAI's GPT models can become costly. The largest GPTs are all pricing on a consumption model, which leads to revenue paradox: the higher your user adaptation, the more your company needs to pay.

Regulatory Compliance

Emerging regulations, such as the EU's AI Act, impose additional costs on AI providers to ensure compliance. These regulations require companies to implement robust risk management systems, transparency measures, and ethical guidelines. What’s more, the regulatory landscape surrounding AI is still evolving. Staying compliant requires ongoing legal counsel and adjustments to your product.

Given these costs, a robust monetization strategy is key to offset expenses and generate revenue that can be reinvested into AI innovation. This approach ensures long-term profitable growth.

The Essential 4 Ps for AI Monetization

Struggling to achieve ROI from your AI features or offering? Thales and Simon-Kucher team up to present a step-by-step guide to monetizing AI.

Turn AI Investments into Profits

Creative Pricing and Packaging Strategies Can Help You Overcome AI’s Cost Complexities

When SaaS emerged, decision making was designed to fuel hypergrowth, often at the expense of immediate profitability. One venture after the next disrupted the market, created new categories, and capturing market share, with investors willing to finance high costs. Monetization, including pricing and packing, was largely overlooked.

In contrast, what’s happening with AI reflects a maturation of the tech industry. There's an earlier focus on how to monetize AI and achieve a return on investment. Successful companies are getting creative with pricing and packaging to turn investments into profits. They are intentionally designing options that reflect customer needs, usage patterns, and willingness to pay.

There's no proven monetization standard yet for AI. AI monetization is an evolving process that requires adaptability.

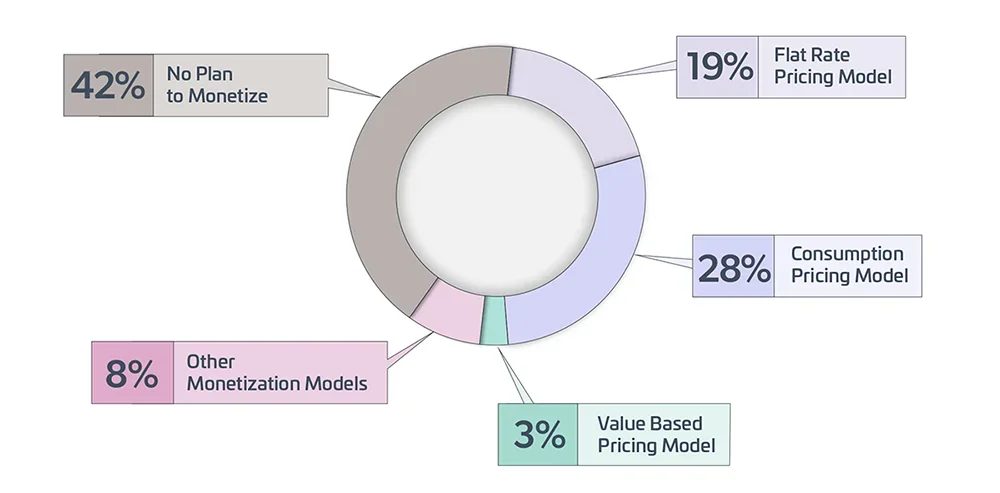

According to a report by Emergence, a leading venture capital company, these are the top pricing models in the AI market:

Favored Pricing Models in AI

How To Find a Pricing Model That Will Work for Your AI Go-To-Market

Let’s delve deeper into the details of finding and applying AI pricing models.

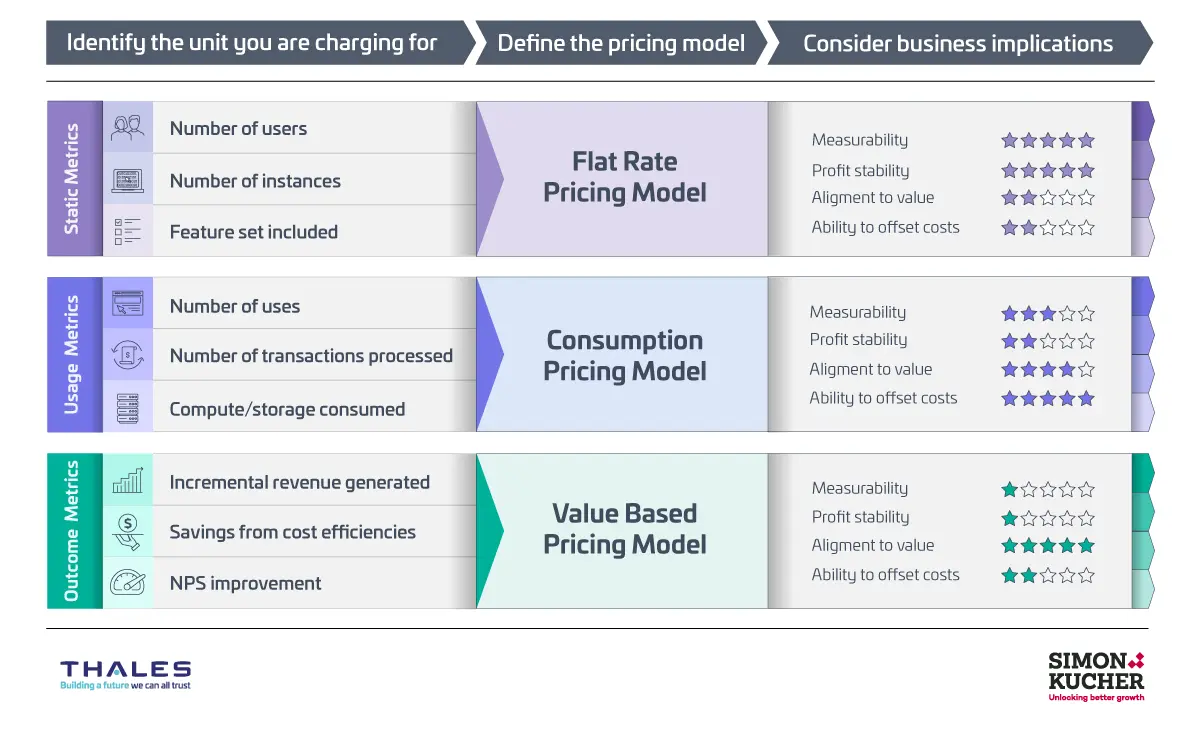

The first step is to identify the appropriate metric to anchor your AI pricing strategy.

The core pricing metrics are:

- Static Metrics

- Usage Metrics

- Outcome metrics

After pinpointing a workable metric, it can be matched with an appropriate pricing model. It's important to understand the business implications of each pricing framework. Take a look at our guide below. You’ll see that some metrics are simpler to measure but yield lower profits, while others may provide greater stability but don’t accurately capture customer willingness to pay. By thoughtfully evaluating each of these elements you can select an AI pricing approach that best aligns with your broader business goals.

Choosing an AI Pricing Model

1. Static Metrics

Flat Rate Pricing Model For AI

Pricing is tied a single, static unit of measurement, such as per user (seat), per feature set, or number of install instances. Flat rate pricing is commonly sold through classic subscription tiers. For example, you’ll can purchase access for one user with limited features, or 10 users with more features, and 100 users with all features.

At the same time, user seats and features don't necessarily have to be bundled. Some AI providers offer more flexible models where customers can choose a subscription level and add user seats as needed. For instance, a small team might need high-level functionality but only for a handful of users, or a larger organization might need basic features for many users. By decoupling seats from feature tiers, providers can use static metric pricing to cater to a wider range of customer needs and potentially capture more market segments.

2. Usage Metrics

Consumption-Pricing Model For AI

This model charges customers based on their usage of the AI service, such as the number of API calls, amount of data processed, or computational resources consumed. Usage-based pricing allows businesses to align costs with actual usage, which is especially important for AP pricing because your costs are likely to increase with consumption.

This model works based on two basic concepts: Tokens and usage metering. Users buy tokens upfront and consume them as they interact with different AI functionalities. The usage metering tracks the number of tokens consumed by each customer over time. When customers deplete their tokens, they can buy more. This gives vendors a recurring income stream without putting undue pressure on clients to buy large volumes upfront.

Until now, consumption-based pricing struggled to really penetrate the market. But unique cost dynamics and the need to monetize AI might just push consumption pricing over the tipping point. Consumption solves the core challenge with AI profitability, which is that success (measured by user adoption) creates a cost burden for the vendor. Consumption models offer a solution: By charging based on usage, vendors can ensure they're compensated for the value their AI delivers, avoiding a scenario where high costs eat away at their return on investment.

3. Outcome Metrics

Value/Outcome-Based Pricing Models For AI

Using outcome or value-based metrics, charges are based on a result delivered by using the AI solution, such as cost savings, increased revenue, or improved efficiency. This model aligns the AI with customer success. But it can be complex to implement and measure.

To implement value pricing, you need to measure performance metrics and calculate value. You’ll want to quantify indicators, such as increased revenue, cost savings, or productivity improvement, that are agreed upon by both parties at the outset.

After measuring performance improvement, you need a method to translate these performance improvements into monetary terms. This could be a percentage of the value created or a fixed fee tied to specific outcome thresholds. Regular performance reviews and adjustments are typically part of this model to ensure fair pricing as outcomes change over time.

This model is one of the most complex, and creative ways to price a product, and has long been considered unrealistic. But because AI products promise to bring transformative change to users, this might be an opening for reconsidering value/outcome-based pricing.

The Constant Movement of AI Demands Pricing Flexibility

AI technology is developing at such a fast pace that how you pricing and packaging today is likely going to change. Here's why agility is especially crucial for evolving AI monetization strategies:

- Uncertain Value Proposition: AI's value often lies in its ability to optimize processes and generate efficiencies that can be hard to quantify initially. A flexible model allows you to adjust pricing as the true value of the AI component becomes clearer.

- Diverse Customer Needs: B2B customers have varied needs and budgets. A flexible approach lets you tailor your offering to different customer segments, maximizing reach and revenue potential.

- Rapid AI Evolution: The AI landscape is constantly evolving. A flexible model allows you to adapt your pricing and packaging to keep pace with new functionalities and use cases.

Companies need to plan their pricing operations with flexibility at the forefront, knowing that whatever pricing metric they decide to monetize might change in the future.

Operationalizing Your AI Pricing Models

Tools and Processes for Operationalizing Your AI Monetization

We’ve shown the importance of a robust AI monetization strategy for building profitability quickly. We’ve also explored various pricing models and discussed how navigating the ever-shifting AI landscape demands agility.

Now let’s shift to the tools and processes for operationalizing your AI monetization strategy. Many companies fall into the trap of thinking they can use business systems like billing, CRMs, and access management platforms to piece together monetization. But those platforms have their own core strengths, disconnected from monetization. With the AI industry so focused on ROI, it is more important than ever to assemble the correct tech stack that will support all operations, including monetization. Therefore, we strongly suggest you establish a monetization hub with licensing and entitlement capabilities at its core. Such a platform will enable you to control user access, implement flexible pricing models, and automate workflows—all with the goal of turning your AI investment into a revenue powerhouse.

Here’s a breakdown of the strengths of limitations of each of the core systems in your business tech stack.

Billing Platform

- Strengths: Streamlines invoicing and payment collection, ensuring smooth financial transactions.

- Limitations: Focuses primarily on processing payments, doesn't handle feature access or user experience tied to different pricing models.

CRM

- Strengths: Manages customer interactions and relationships, helps identify upsell and cross-sell opportunities.

- Limitations: Doesn't control feature access or pricing models, making it difficult to directly tie CRM activities to revenue growth.

Access Management Systems

- Strengths: Provides a basic level of control over user access, ensuring users can only access authorized functionalities.

- Limitations: Access management systems are not designed to solve for use cases where access to product and features (SKUs) is automated from an ERP/CPQ/billing systems.

Homegrown

- Strengths: Often seen as the easiest way to get started. No reliance on an outside vendor, and you can build exactly what you need for your use cases.

- Limitations: Requirements of the system balloon quickly, requiring significant investment in development and maintenance.

Monetization Hub with Licensing and Entitlements

- Feature Access Control: Entitlements allow for defining precise access levels for each pricing tier. This gives you the ability to offer tailored product tiers that align with customer willingness to pay and incentivizes customers to choose higher tiers.

- Dynamic Licensing Models: Creates flexibility for implementing pricing models, including subscription plans, tiered pricing, and usage-based billing models.

- Automated Workflows: Provides a single source of truth from which user provisioning and billing based can be operationalized.

- Data-Driven Insights: Provides valuable data on feature usage and customer behavior, helping identify sales opportunities of upgrades, upsells, and cross-sells, as well as optimizing pricing models and roadmapping new feature development.

A monetization platform with entitlements goes beyond just processing payments (billing) or managing customer relationships (CRM). It provides the tools to directly control product and feature access, implement flexible pricing models, and automate revenue-generating workflows.

Sentinel Is the Market’s Leading Solution for AI Software Monetization

Sentinel is a pioneer in AI monetization, with a proven track record of helping leading AI companies like Lunit AI, which creates AI for cancer detection, and Alchera, a leader in facial recognition technology, protect and profit from their innovations.

Sentinel provides a software monetization platform for AI that allows you to operationalize any pricing model with licensing technology and automates the software order to fulfillment process other changes throughout the subscription lifecycle. This workflow ensures a standard software order to fulfillment process, with users receiving access to only the features, products, and services they paid for. Sentinel's protection technology guarantees that only authorized users can unlock access maximizing security and preventing overuse, underuse, and even piracy.

Managing entitlements centrally and with a single source of truth creates clear visibility of how your customers are using their purchases. This unique data set is a source of revenue opportunities, that powers your up-sell and cross-sell strategy. This adds another layer of monetization to deliver a strong return on you AI investments.