Miglioramento dell'on-boarding digitale

Per garantire un'esperienza di on-boarding senza inconvenienti per i nuovi clienti, gli istituti finanziari (IF) devono adottare le giuste misure di sicurezza nella raccolta e nella convalida dei documenti di identità. Se abbinati agli strumenti di orchestrazione del percorso dell'utente e di gestione dei consensi / preferenze della nostra piattaforma, le banche e gli istituti finanziari possono offrire ai loro clienti finali la migliore esperienza di on-boarding digitale possibile.

Rispetto dei requisiti normativi

Implementa i meccanismi di sicurezza essenziali, conformi a normative rigorose, come KYC(Know Your Customer), AML (antiriciclaggio), Direttiva v5 e v6, direttiva europea PSD2 e altre ancora.

Massimizza l'esperienza dell'utente

Ottimizza l'esperienza di on-boarding per ottenere la massima facilità e convenienza per i clienti.

Coltiva una sicurezza senza pari

Riduce al minimo i furti di identità e le frodi con funzionalità avanzate di affermazione dell'identità per un livello superiore di garanzia.

#2024TRUSTINDEX

L'80% dei consumatori

si aspetta un'esperienza di on-boarding completamente digitale. Non si tratta più di una caratteristica aggiuntiva o "Nice-to-have", l'impostazione di un percorso di on-boarding digitale con il giusto set di strumenti è fondamentale.

Cos'è l'Autenticazione dell'identità (IDV)?

L'Autenticazione dell'identità, talvolta definita prova dell'identità o convalida dell'identità, è il processo di conferma dell'autenticità di un'identità fornita da un individuo. Si tratta di raccogliere e convalidare le informazioni personali attraverso vari mezzi, come documenti ufficiali o dati biometrici. Questo processo è fondamentale per prevenire frodi e attività illecite nel contesto delle transazioni e degli accessi on-line. I metodi di autenticazione come il riconoscimento facciale e la scansione delle impronte digitali miglioreranno il processo di verifica.

Scopri come i servizi di on-boarding della piattaforma OneWelcome Identity Platform di Thales possono supportare la tua azienda in tutte queste aree, all'interno di un'unica piattaforma di facile utilizzo.

SCOPRI LE SOLUZIONI DI THALES

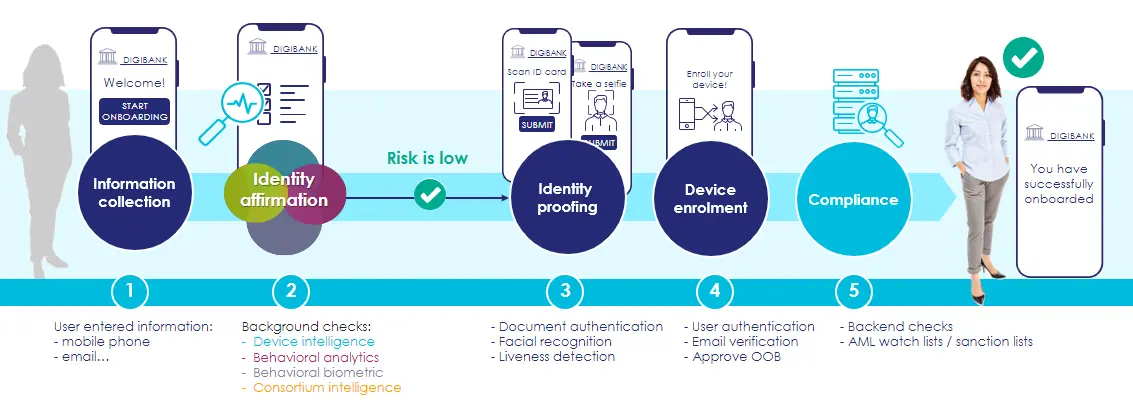

Come funziona il servizio di on-boarding della piattaforma OneWelcome Identity Platform di Thales? Un metodo in quattro fasi per prevenire le frodi

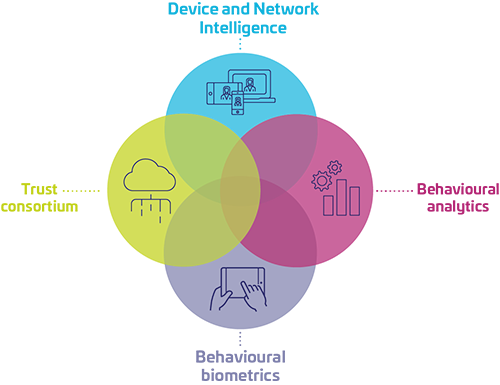

I nostri servizi gestiti basati sul cloud offrono una protezione dell'identità per un on-boarding sicuro. La gestione del rischio aumenta ulteriormente la sicurezza e migliora l'esperienza del cliente con l'affermazione dell'identità. I servizi di gestione del rischio della piattaforma OneWelcome Identity Platform di Thales utilizzano quattro livelli di intelligence per confermare le identità e autenticare in base al rischio. Questi livelli analizzano le attività degli utenti e dell'ambiente da diverse angolazioni per individuare i rischi elevati prima che si verifichi una problematica. In questo modo si garantisce l'identificazione di consumatori affidabili in base alle loro azioni on-line.

Questi livelli di intelligence creano un profilo dinamico di ogni evento che protegge i clienti e le aziende e consente di rilevare le frodi nel settore bancario.

Schema di Autenticazione dell'identità in 4 fasi

Casi d'uso dell'identità

Autenticazione dell'identità del cliente

Verifica i clienti nuovi ed esistenti con il massimo livello di sicurezza. Introduci controlli di autenticazione continui e sicuri sfruttando la biometria, la verifica dei documenti e l'analisi dei rischi.

Semplificazione dell'IAM

Scopri come possiamo favorire la sicurezza delle identità

Thales è stata nominata leader assoluto di mercato

Individua il prodotto o il servizio che meglio soddisfa le esigenze della tua azienda e scopri perché KuppingerCole ha nominato Thales leader di mercato, leader globale e leader dell'innovazione nella gestione degli accessi

L'intelligenza artificiale sta ridefinendo l'Autenticazione dell'identità

Nell'era dell'IA generativa e dei deep fake diffusi, la protezione dalla manipolazione dipende da soluzioni affidabili di autenticazione e affermazione dell'identità, come il servizio di On-boarding della piattaforma OneWelcome Identity Platform di Thales.

L'integrazione dell'intelligenza artificiale nell'autenticazione dell'identità è destinata a ridefinire i protocolli di sicurezza. La capacità dell'intelligenza artificiale di elaborare grandi quantità di dati e riconoscere modelli ha implicazioni di vasta portata per l'autenticazione dell'identità. Questa evoluzione richiederà un ripensamento strategico delle attuali misure di sicurezza.

Risorse consigliate

Domande frequenti

Il servizio di On-boarding della piattaforma OneWelcome Identity Platform di Thales impiega metodi avanzati di lettura dei documenti, verifica facciale, biometria comportamentale e funzionalità di Gestione del rischio per garantire un'autenticazione e una prova dell'identità sicure.

Sì, il servizio di On-boarding della piattaforma OneWelcome Identity Platform di Thales è progettato per integrarsi perfettamente con diversi sistemi e piattaforme, offrendo soluzioni flessibili e scalabili su misura per le esigenze aziendali.

Il servizio di On-boarding della piattaforma di identità Thales OneWelcome è conforme alle normative e ai requisiti del settore, come KYC (Know Your Customer), AML (Anti-Money Laundering), GDPR (General Data Protection Regulation) e altro ancora, garantendo la compliance normativa e la protezione dei dati.